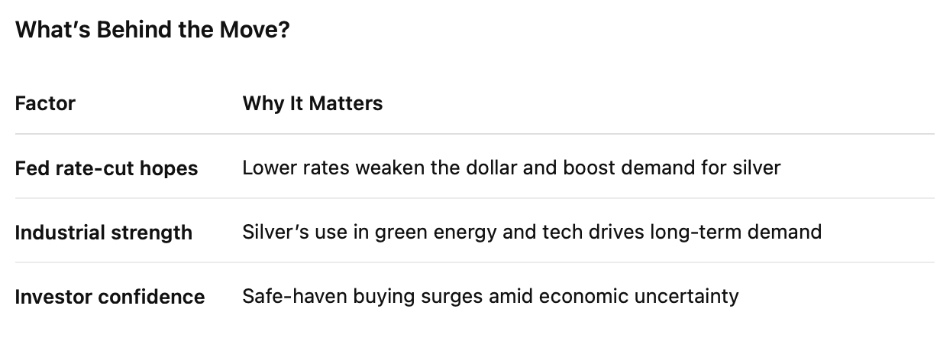

Silver is making headlines—recently climbing back above the $40 mark, a level not seen since 2011. This renewed strength comes amid whispers of a potential Federal Reserve rate cut, growing industrial demand, and ongoing geopolitical concerns. Let’s dig into what’s behind this rally and what it means for investors following the silver price today.

Current Silver Market Snapshot

-

Breaking Through $40

Silver recently opened around $40.75 per ounce, marking its first trade above $40 since 2011. This spike follows a sharp rally of about 5% over just two trading days.

-

New Highs Amid Tangled Markets

The surge coincides with expectations that the Fed may soon shift toward rate cuts—fueling demand for precious metals as investors hedge risks.

-

Industrial & Retail Lift

Surging industrial demand—especially in sectors like solar energy—and record-breaking retail buying (particularly in India) are adding fuel to the price rally.

-

Safe-Haven Appeal Grows

With global markets volatile, investors are flocking to silver as a hedge—pushing demand beyond speculative levels.

-

Forecasts Look Bullish

Analysts expect this rally could extend well past current price levels, with top forecast models setting sights as high as $50 per ounce.

What It Means for You

-

Timing Is Key

Whether you’re investing or trading, silver’s upward momentum makes it hard to ignore. Whether you’re buyer or holder, now is a moment to evaluate your position.

-

Safe with Growth

Combining silver’s traditional hedge appeal with industrial demand may offer both stability and upside potential.

-

Stay Informed

The interplay of central bank policy, demand shifts, and global events will continue driving silver’s trajectory.

Silver’s return to the $40 level signals more than a routine upswing—it’s part of a broader shift in global markets. Propelled by rate-cut speculation, demand from industry and retail, and growing economic uncertainty, silver is poised to shine. Whether you’re defending wealth or seeking smart gains, keeping a close eye on silver could pay off.

CEO and Founder of CanAm Bullion has been dedicated to delivering exceptional value to Canadians since 2017. Driven by a mission to empower Canadians with expert investment advice and education, he has positioned CanAm Bullion as a trusted resource for those seeking to enhance their portfolios with precious metals. Under Michael’s leadership, the company has become synonymous with reliability, knowledge, and dedication, helping Canadians achieve greater financial stability and long-term success.

Share This Article

Choose Your Platform: Facebook Twitter Google Plus Linkedin